When I talk to business owners, I often hear the same thing: “We didn’t see that coming.” Whether it’s a data breach, a market shift, or an operational failure, companies are constantly blindsided by risks they should have anticipated. Creating a culture of risk awareness isn’t just smart—it’s essential for survival in today’s unpredictable business environment.

In this article, I’ll walk you through concrete steps to build a risk-aware culture that empowers your team to identify, assess, and respond to threats before they become crises. You’ll learn how to conduct effective risk assessments, secure leadership buy-in, develop mitigation strategies, and foster open communication about risks throughout your organization.

Start Smart

The first step toward building a risk-aware culture is establishing a common risk vocabulary across your organization. Companies struggle simply because different departments define “high risk” differently.

Begin by creating a unified framework that defines risk categories relevant to your business. These include operational risks, financial risks, compliance risks, strategic risks, and reputational risks. Ensure everyone from the C-suite to front-line employees understands these definitions and can speak the same language when discussing potential threats.

This shared vocabulary removes ambiguity and enables clearer communication about risks. When I worked with a healthcare provider last year, they reduced incident reporting time by 40% simply by standardizing their risk terminology. Getting everyone on the same page isn’t just about efficiency—it creates the foundation for all your risk management efforts.

Conduct a Risk Assessment

A comprehensive risk assessment reveals your organization’s vulnerabilities and provides a baseline for measuring progress.

Start by involving key stakeholders from different departments. Risk isn’t siloed in one area of your business, nor should your assessment process be. The finance team might spot different threats than your IT department or operations team.

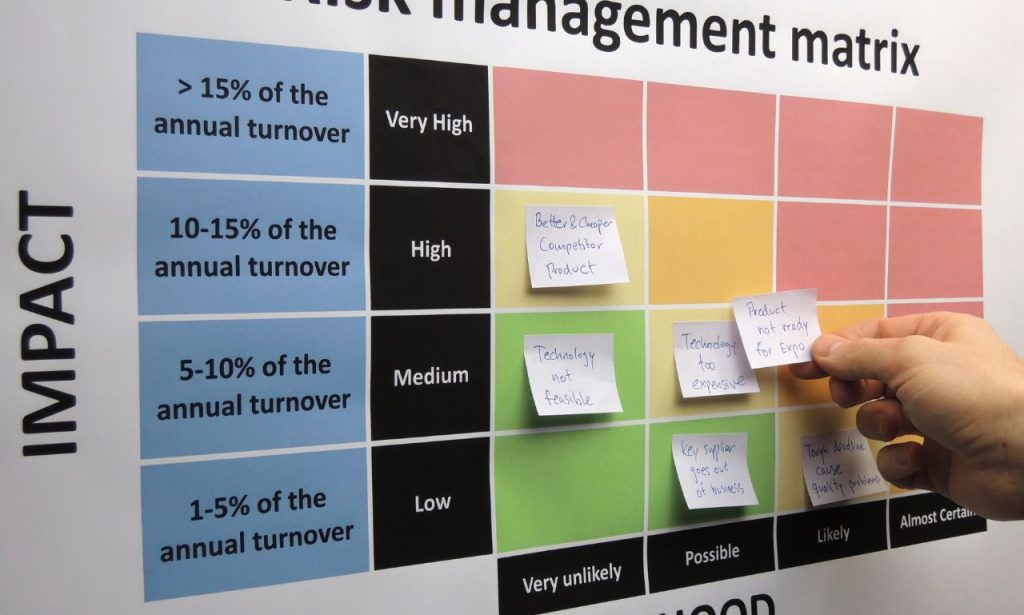

I recommend using a structured approach: identify potential risks, analyze their likelihood and potential impact, evaluate which ones require immediate attention, and document your findings. Tools like risk matrices can help visualize where your most significant vulnerabilities lie.

The most successful companies I’ve worked with don’t treat risk assessment as a one-time event. They build regular reassessments into their business rhythm—quarterly at minimum. The business landscape changes constantly, and your risk assessment needs to keep pace.

Invest in Tools and Resources

You wouldn’t expect a carpenter to build a house without proper tools. Similarly, your team needs the right resources to create a risk-aware culture. This means investing in both technology and training.

On the technology front, consider implementing risk management software that provides real-time insights and centralizes your risk data. I’ve seen organizations transform their approach to risk by simply having better visibility. When a manufacturing client implemented a risk dashboard accessible to all department heads, they identified cross-functional risks that had previously gone unnoticed.

Equally important is training. Your people are your first defense against risks, but only if they know what to look for. Regular workshops, scenario planning exercises, and risk simulation drills help embed risk awareness into everyday thinking. The best programs I’ve seen combine technical training with soft skills like effective risk communication and decision-making under uncertainty.

Remember, tools and training aren’t one-size-fits-all. Tailor your investments to your specific risk profile and organizational needs.

Instill Leadership Commitment Early On

Nothing kills a risk-aware culture faster than leaders who pay lip service to risk management but don’t back it up with action. Leadership commitment isn’t optional—it’s the engine that drives cultural change.

Your leadership team must visibly embrace risk awareness in their decisions and communications. This means allocating sufficient resources to risk management, participating in risk discussions, and considering risk implications in strategic planning.

I’ve observed that the most risk-mature organizations often have risk oversight built into their governance structure. This might mean adding risk experts to your board, establishing a dedicated risk committee, or making risk management a standing agenda item in executive meetings.

One tech company I advised made an interesting move: they tied executive compensation partially to risk management performance. Suddenly, leaders had a personal stake in strengthening the organization’s risk posture. Their risk reporting improved by 200% within six months. When leaders truly commit to risk awareness, the rest of the organization follows suit.

Create a Risk Mitigation Plan

You need clear action plans to address them. A robust risk mitigation plan establishes ownership, timelines, and success metrics for managing each significant risk.

Your plan should prioritize risks based on their potential impact and your organization’s risk appetite. Not all risks require the same level of attention or resources. For each priority risk, outline specific strategies: will you accept, avoid, transfer, or reduce the risk?

The most effective mitigation plans I’ve seen contain these key elements:

- Assigned accountability for each risk

- Specific, measurable actions to address the risk

- Deadlines for implementation

- Regular review points to assess effectiveness

- Contingency plans if initial strategies prove insufficient

A mitigation plan isn’t a static document. It should evolve as your risk landscape changes and you learn from your risk management experiences. I recommend quarterly reviews at a minimum, with more frequent check-ins for high-priority risks.

Communicate Expectations

Even the best risk management strategy will fail if expectations aren’t communicated throughout the organization. Everyone needs to understand their role in maintaining risk awareness.

Start by making risk management responsibilities explicit in job descriptions and performance reviews. When risk awareness becomes part of how people are evaluated, it quickly becomes part of how they work. One retail client incorporated risk identification into their employee recognition program, celebrating team members who proactively flagged potential issues.

Regular communication about risk should flow in all directions—top-down, bottom-up, and across departments. Creating forums where employees can discuss emerging risks without fear of blame builds trust and encourages transparency.

I’ve found that the organizations with the strongest risk cultures don’t just communicate when things go wrong. They also share risk management successes and lessons learned, reinforcing the value of risk awareness.

How to Create a Risk-Aware Culture?

Creating a genuinely risk-aware culture goes beyond policies and procedures, changing how people think and behave. I’ve identified three pillars that support this transformation:

First, make risk awareness convenient. If identifying and reporting risks is cumbersome, people won’t do it. Streamline your processes and make risk management tools easily accessible. One hospital reduced its risk incidents by 30% after implementing a simple mobile app for reporting potential safety issues.

Second, recognize and reward risk awareness. Celebrate employees who identify risks early, even if those risks never materialize into problems. This positive reinforcement shifts the mindset from “risk management is extra work” to “risk awareness is valued here.”

Third, risk discussions should be integrated into everyday business activities. When risk becomes part of regular team meetings, project planning, and strategic discussions, it stops being seen as a separate function and starts being recognized as an essential business practice.

How Do You Create a Culture of Risk-Taking?

This might sound counterintuitive after discussing risk awareness, but healthy organizations balance prudent risk management with calculated risk-taking. Innovation requires some risk, and organizations that fear all risk quickly become stagnant.

The key is distinguishing between smart risks and reckless gambles. Clear risk tolerance guidelines help teams understand what risks are acceptable in pursuing business objectives. I worked with a financial services firm that created a “risk sandbox”—a defined space where teams could experiment with new ideas within predetermined risk parameters.

Encourage teams to approach opportunities with both enthusiasm and clear-eyed risk assessment. When people understand the risk landscape, they can make informed decisions about risks worth taking and which should be avoided.

What Are the 5 Characteristics of a Risk Culture?

Through my work with hundreds of organizations, I’ve identified five characteristics that define a strong risk culture:

- Transparency: Information about risks flows freely throughout the organization, without fear of blame or retaliation.

- Accountability: Everyone understands their risk management responsibilities, and ownership of specific risks is assigned.

- Learning orientation: The organization treats risk events and near-misses as opportunities to improve rather than failures to hide.

- Balance: There’s a healthy equilibrium between risk aversion and risk-taking, aligned with strategic objectives.

- Integration: Risk management isn’t siloed but woven into all business processes and decision-making.

Organizations that embody these characteristics don’t just avoid disasters—they make better decisions, allocate resources more effectively, and build greater resilience.

Conclusion

Creating a culture of risk awareness isn’t a one-time project—it’s an ongoing journey that requires commitment at all levels of your organization. By establishing a common risk language, conducting thorough assessments, investing in tools and training, securing leadership buy-in, developing mitigation plans, and communicating expectations, you’ll build a foundation for risk awareness that strengthens your entire organization.

Remember that the goal isn’t to eliminate all risks. Instead, it’s to ensure your team can identify, understand, and respond appropriately to the risks that matter most. When risk awareness becomes part of your organizational DNA, you transform potential threats into opportunities for growth and improvement.

ALSO READ: Why You Should Consult an Attorney Before Forming Your Business Entity

FAQs

Risk awareness is identifying, understanding, and responding appropriately to potential threats to your organization’s objectives, assets, or operations.

At minimum, conduct comprehensive risk assessments annually, with quarterly reviews of high-priority risks and immediate reassessments when your business environment changes significantly.

Risk management is the formal process of identifying, assessing, and mitigating risks, while risk awareness is the broader cultural mindset that makes everyone alert to potential threats.

Track metrics like the number of risks identified before they become issues, time to respond to emerging risks, and employee feedback about comfort levels in discussing potential threats.

Absolutely. While the scale may differ, organizations of all sizes benefit from structured approaches to identifying and managing risks, often more critically for small businesses with fewer resources to recover from setbacks.